sales tax on leased cars in maryland

Info MVA Home Titling A Vehicle. The fee for titling a vehicle typically includes a title fee excise tax and a security interest lien filing fee if required.

Used Cars In Maryland For Sale Enterprise Car Sales

You can calculate the trade-in incentive on your vehicle by applying this percentage to your new car price.

. These fees are separate from. In Maryland does the dealer charge sales tax on the entire price of the vehicle when leased same as if it was purchased. Average DMV fees in Maryland on a new-car purchase add up to 105 1 which includes the title registration and plate fees shown above.

Mail In Title Unit. Hey Hackers I am considering leasing a vehicle instead of buying it for the 1st time. The potential saving costs for 288 trade-in worth 5000.

Remember that sales tax applies to the total. Some lease buyout transactions may be excise tax exempt. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

Multiply the vehicle price before trade-in or incentives by the sales tax fee. Ask the Hackrs. Every time you purchase taxable tangible goods from.

Certain short-term truck rentals are subject to an eight 8 percent tax. Maryland Documentation Fees. On average 575 applies as a car trade-in services in Maryland while purchasing a new car according to new rules and regulations.

For example the combined taxes imposed for leasing a 15000 car and then buying it after two years were 1521 in Maryland. For example imagine you are purchasing a vehicle for 20000 with the state sales tax of 725. The fee for registration varies by the type of vehicle its weight andor its intended use.

There is a new alcohol tax rate of nine. See Fees for Registration Plates for more information. With a 24 month lease that increases the monthly by 55.

Remember that the total amount you pay for a car out the door price not only includes sales tax. And I am being told that for Maryland I have to pay the whole car price in tax IE 22000 price after negotiations x 6 1320. For instance an 11½ percent tax is imposed on short-term passenger car and recreational vehicle rentals.

6601 Ritchie Highway NE. To calculate the sales tax on your vehicle find the total sales tax fee for the city. While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Businesses in Maryland are required to collect Marylands 6 percent sales tax and or 9 percent alcoholic beverage tax from you whenever you make a taxable purchase. To learn more see a full list of taxable and tax-exempt items in Maryland. MVA Customer Service Center.

Rocktimberwolf December 21 2015 252am 1. Please provide a credible reference to confirm this if possible. Sales tax on Maryland leased vehicle.

Sales Tax 40000 06. Glen Burnie MD 21062. Or is the sales tax only on the lease payment portion.

This page describes the taxability of leases and rentals in Maryland including motor vehicles and tangible media property. State sales taxes apply to purchases made in Maryland while the use tax refers to the tax on goods purchased out of state. In these special situations there may be a special tax rate charged rather than the six 6 percent sales and use tax rate.

Sales Tax 2400. The minimum is 725. In contrast taxes were 450 in Virginia.

Used Cars For Sale In Hagerstown Md Cars Com

Nj Car Sales Tax Everything You Need To Know

Used Toyota For Sale In Baltimore Md Cars Com

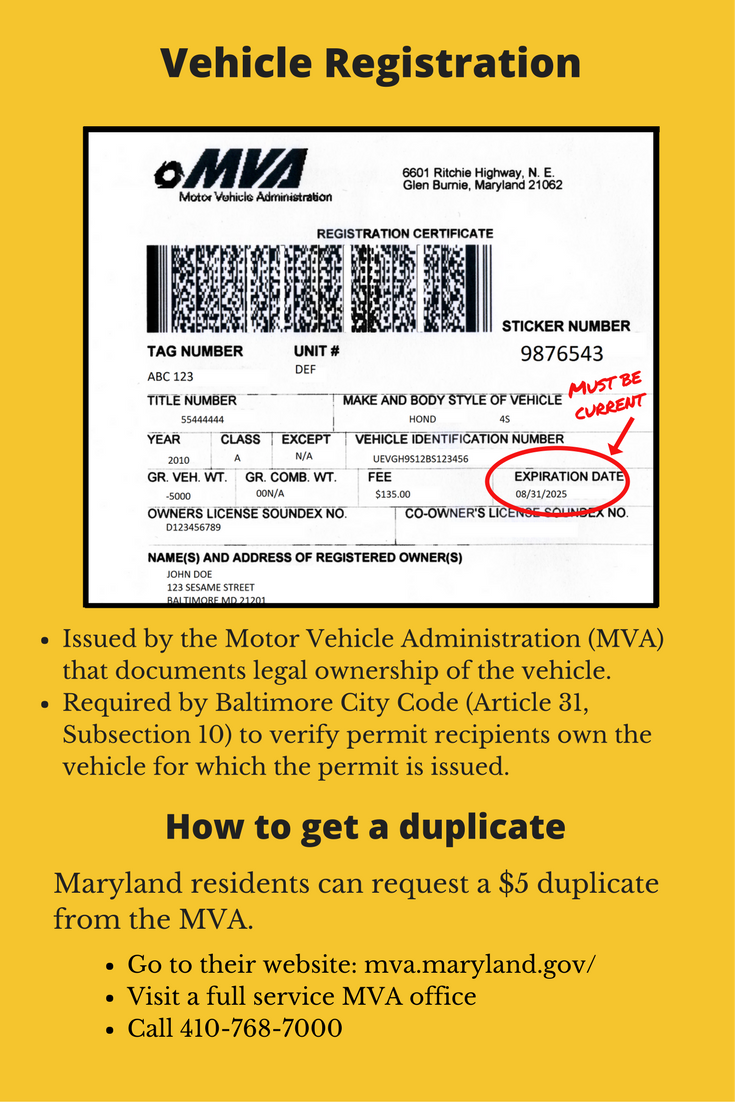

Required Customer Documents Parking Authority

Used Cars In Laurel Md For Sale

Used Hyundai Accent For Sale In Baltimore Md Edmunds

Used Cars For Sale In Maryland Edmunds

Used Cars Salisbury Maryland Pohanka Toyota Of Salisbury

Used Cars Salisbury Maryland Pohanka Toyota Of Salisbury

Maryland Car Tax Everything You Need To Know

Used Honda Civic For Sale In Baltimore Md Edmunds

Sales Tax On Cars And Vehicles In Maryland

Proposed Riverfront Stadium Gets A Name National Car Rental Field